Articles | May 14, 2025

Tariff Uncertainty Continues

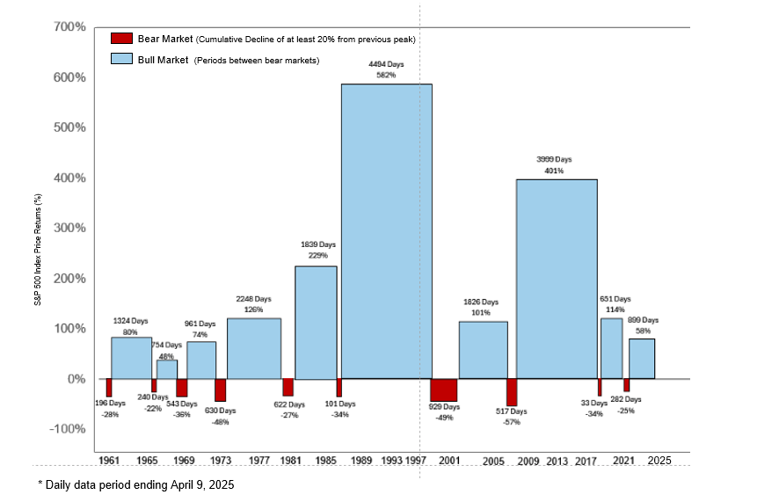

What a rollercoaster 2025 has been. While difficult to understand and more difficult to watch, we once again caution our clients against knee-jerk reactions to these events. While attempting to contemplate the outcome of events is nearly impossible, we take solace in the long-term historical patterns of the markets over the last 50+ years. The chart below is one way of viewing the ups and downs of equity markets, and it helps to contextualize by noting that staying invested in the markets is a good thing. That may not make today’s volatility feel better, but it does help us to take a step back and remember the long term versus the short term.

Source: Factset

Recap of key tariff actions

- March 4 – Announced a 25 percent tariff on products from Mexico and Canada. However Canadian energy resources only taxed at 10 percent. Tariff of 20 percent placed on Chinese imports. Canada responded with retaliatory tariffs on more than $100 billion of U.S. goods (25 percent tariff).

- March 5 – Temporarily exempted auto imports from Canada and Mexico from tariff (which was reinstated).

- March 6 – Announced that tariffs not applied to goods compliant with the United States, Mexico Canada Trade Act (USMCA) until global reciprocal tariffs were to be launched on April 2.

- March 12 – Tariff of 25 percent placed on all aluminum and steel imports. Canada responds again with retaliatory tariffs on CAD$29.8 billion of U.S. imports (25 percent tariff).

- April 2 – “Liberation Day”. Under the International Emergency Economic Powers Act (IEPPA) of 1977, Trump imposed a 10 percent baseline tariff on all countries effective April 5. Additional individualized reciprocal tariffs above the baseline to be placed on imports from countries with whom the U.S. has the largest trade deficits, effective April 9. These additional reciprocal tariffs would include China (34 percent), Vietnam (46 percent), Japan (24 percent), European Union (20 percent), and India (26 percent). Goods not subject to reciprocal tariffs include steel/aluminum/autos/auto parts already subject to tariffs, as well as copper, pharmaceuticals, semiconductors, lumber, bullion, energy and other minerals not available in the U.S. For Canada and Mexico, the existing tariff program remains in effect: USMCA-compliant goods, 0 percent; non-compliant goods, 25 percent; and auto parts imported for U.S.-based production will have a tariff imposed in May. If Canada and Mexico demonstrate meaningful progress on border control and fentanyl trafficking issues, tariffs on imports may be reduced to 12 percent. The next day, Canada imposes a surtax on electricity exported from Ontario to U.S. states (25 percent). Furthermore, Canada imposes retaliatory tariffs on vehicles imported from the U.S. that are not CUSMA-compliant (25 percent).

- April 9 – Paused the global reciprocal tariffs for 90 days on “non-retaliating countries” but retained the 10 percent baseline levy on all imports. Increased effective tariff rate to 145 percent on Chinese goods. China retaliated by raising tariff on U.S. goods to 125 percent from 84 percent previously.

- April 11 – Temporarily exempted smartphones, computers and other devices and components from reciprocal tariffs.

Markets:

The initial reaction to the pause on tariffs was positive (the markets were up on Wednesday April 9, as the S&P climbed 9.5 percent and the Nasdaq 12.0 percent) but the next two days were up and down. For the week, the indices finished stronger, with Dow gaining 5 percent, the S&P 500 moving up 5.7 percent (best week since November 2023), and the Nasdaq jumping 7.3 percent (best week since November 2022). The VIX also closed out the week at 37.56, which was down 3.16 points for the day and below the 50.0 mark reached earlier in the week. It appeared the Boston Fed president was signaling that the central bank is prepared to step in as necessary to stabilize markets, and the President expressing confidence in a forthcoming trade deal with China had a calming effect. The Canadian equity market followed the U.S. market volatility and recovery into late April.

However, the real action this week was in the Treasury market. While Treasuries had previously acted as a hedge to market volatility, rates rose, the volatility of the market spiked, and liquidity dropped. The 10-year increased approximately 50 basis points to 4.49 percent, while the 30 year was up 48.2 points to 4.87 percent. It appears investors are still concerned about the future direction of rates and amidst the continued uncertainty, despite the recent pause in tariffs.

The first quarter earnings season began with large banks, often seen as a bellwether for the economic outlook. The fundamentals of the markets will be underpinned by the results over the coming weeks of announcements.

As the chart at the top shows, markets have seen greater highs than lows historically. Stay the course, and know we are here for any questions or concerns.

See more insights

Q4 2024 Investment Market Update

Corporate Governance Developments in Canada